\(\newcommand\F[2]{\mathit{#1}\left(#2\right)}\) \(\newcommand{\minR}{\mathit{min_r}}\) \(\newcommand{\maxR}{\mathit{max_r}}\) \(\newcommand{\tmult}{\cdot}\) \(\newcommand\static[1]{\F{static}{#1}}\) \(\newcommand{\sfr}{\frac{1}{1600}}\) \(\newcommand\tc{\tau_c}\) \(\newcommand\tr{\tau_r}\) \(\newcommand\grf{\gamma}\) \(\newcommand\dyn[1]{\F{dyn}{#1}}\) \(\newcommand\sgn[1]{\F{sign}{#1}}\) \(\newcommand\dist[1]{\F{distance}{#1}}\) \(\newcommand\DTF{{\Delta t}}\) \(\newcommand\IL[1]{\normalsize{#1}}\) \(\newcommand\MX[2]{\F{max}{#1,#2}}\) \(\newcommand\adr[1]{\F{adaptive}{#1}}\) \(\newcommand\clip[3]{\F{clip}{#1,#2,#3}}\) \(\newcommand\supply[1]{\F{supply}{#1}}\) \(\newcommand\iss[1]{\F{issuance}{#1}}\) \(\newcommand\isb[1]{\F{issuance_{block}}{#1}}\) \(\newcommand\tw{\Sigma_w}\) \(\newcommand\rw[2]{\F{reward_{#1}}{#2}}\) \(\newcommand\tip[2]{\F{tip_{#1}}{#2}}\) \(\newcommand\exp[1]{\F{exp}{#1}}\) \(\newcommand{\vdf}{\mathit{VDF}}\)

Adaptive Issuance and Staking¶

This document describes Adaptive Issuance and Staking, two new features (referred hereafter as the Adaptive-Issuance/Staking proposal) which together constitute a major evolution of Mavryk’ Proof-of-Stake mechanism.

Note

For operational details about the new staking mechanism and its configuration, see a new staking mechanism tutorial.

Adaptive Issuance¶

Adaptive Issuance is a novel mechanism regulating mav issuance in Mavryk.

The Mavryk economic protocol issues new mav via:

Participation rewards: incentives given to delegates for participation in consensus and random seed generation.

Protocol “invoices”: lump sums of mav issued and allocated during protocol migration.

Participation rewards and the LB subsidy are regularly issued by the protocol, whereas the value and recipients of invoices are defined discretionarily by the developers of a protocol proposal. The values for participation rewards and the LB subsidy, if any, are currently defined by the Mavryk protocol using fixed constants.

The Adaptive-Issuance/Staking proposal introduces the possibility to activate Adaptive Issuance: a mechanism where the amount of participation rewards depends on the global staked funds ratio – that is, the ratio of staked mav to the total supply. This lets issuance roughly match the actual security budget the chain requires, the amount needed to encourage participants to stake and produce blocks, but no more.

At the end of each blockchain cycle, the regular issuance is adjusted, to nudge the staked funds ratio towards a protocol-defined target (set at 50% in the Adaptive-Issuance/Staking proposal). Participation rewards are recomputed to match that budget. When the staked funds ratio decreases and diverges from the target, emission rates increase, incentivizing participants to stake funds to re-approach the target. Conversely, incentives decrease as the ratio increases beyond the target.

Adaptive issuance rate¶

The adaptive issuance rate determines, at the end of cycle \(\IL{c}\), the issuance for cycle \(\IL{c + 3}\). The adaptive issuance rate is the sum of a static rate and a dynamic rate. The final result is clipped to ensure nominal emissions remain within \(\IL{[\minR,\ \maxR]}\) (set to [0.05%, 5%] in the Adaptive-Issuance/Staking proposal) of the total supply.

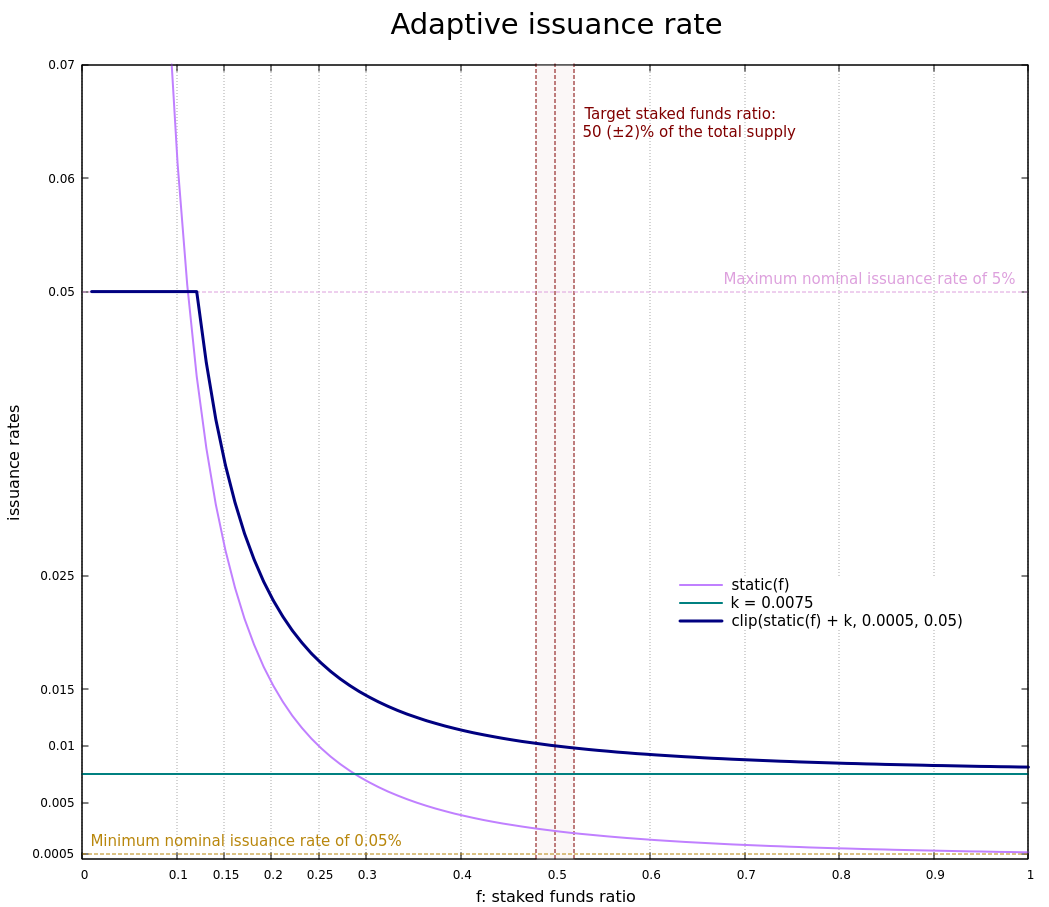

Figure 1. Adaptive issuance rate as a function of the staked funds ratio f.¶

Figure 1 plots the nominal issuance rate and the static rate as a function of the staked ratio \(\IL{f}\). In the graph above, we picked the value 0.0075 (or 0.75%) for the dynamic rate, but this is just an example and that number varies dynamically over time.

The static rate is a static mechanism, which approximates a Dutch auction to compute a nominal issuance rate as a function of the staked funds ratio for a given cycle. Its value decreases as the staked funds ratio increases, and vice versa.

STATIC RATE Let \(\IL{f}\) be the staked funds ratio at the end of cycle \(\IL{c}\). Then, the static rate is defined as:

The choice of \(\IL{\sfr}\) as a scaling factor ensures that the curve takes reasonable values for plausible staking ratios. Moreover, assuming Adaptive Issuance is activated with a dynamic ratio of 0, and at current staked funds ratio (that is, ~7.5% of the total supply), this factor allows for a smooth transition from current issuance rate (~4.6%).

The dynamic reward rate adjusts itself over time based on the distance between the staked funds ratio \(\IL{f}\) and the 50% (±2%) target ratio (\(\IL{\tc}\) and \(\IL{\tr}\) parameters below), increasing when \(\IL{f}\) < 48% and decreasing when \(\IL{f}\) > 52%, provided the total issuance rate is not hitting its lower or upper limit.

DYNAMIC RATE The dynamic rate \(\IL{\dyn{c}}\) is defined at the end of cycle \(\IL{c}\) as:

\(\IL{\dyn{c}}\) is then clipped to \(\IL{\left[ 0, \maxR - \static{\F{f}{c}}\right]}\), ensuring that \(\IL{\static{\F{f}{c}} + \dyn{c} \leq \maxR}\).

In this formula:

\(\IL{c_0}\) is the first cycle where Adaptive Issuance is active.

Given a cycle \(\IL{c}\), \(\IL{\F{f}{c}}\) denotes the staked funds ratio at the end of the cycle, and \(\IL{\dyn{c}}\) the value of the dynamic rate computed in that cycle.

\(\IL{\tc}\) = 0.5 and \(\IL{\tr}\) = 0.02 denote, respectively, the target staked funds ratio and the radius of the interval centered on the target ratio.

\(\IL{\grf}\) = 0.01, controls the speed at which the dynamic rate adjusts. The value is set so that a one percentage point deviation of the staked funds ratio changes the dynamic rate by 0.01 percentage points per day.

\(\IL{\dist{\F{f}{c}} = \MX{0}{\left|\F{f}{c} - \tc \right| - \tr}}\) denotes the (absolute) distance between the staked funds ratio \(\IL{\F{f}{c}}\) and the interval \(\IL{\left[ \tc - \tr, \tc + \tr \right]}\).

\(\IL{\DTF = \frac{16384 \tmult 15}{86400} = 2.8\overline{444}}\), denotes the minimal duration (in days) of a Mavryk cycle, assuming all 16384 blocks in the cycle are produced at the minimal allowed time – that is, every 15 seconds.

\(\IL{\sgn{\tc - \F{f}{c}} = 1}\) if \(\IL{\F{f}{c} \leq \tc}\) and \(-1\) otherwise, denotes the sign of the distance between the target ratio \(\IL{\tc}\) and the staked funds ratio \(\IL{\F{f}{c}}\).

In a nutshell, \(\IL{\dyn{c}}\) increases and decreases by an amount proportional to the distance between the target rate and the interval \(\IL{\left[ \tc - \tr, \tc + \tr \right]}\), while ensuring that the adaptive issuance rate is kept within \(\IL{[\minR,\ \maxR]}\) bounds.

Finally, as mentioned before, the nominal adaptive issuance rate 1 for a cycle \(\IL{c + 3}\) is defined as the sum of the static rate and the dynamic rate, clipped to stay within 0.05% – 5% range.

ADAPTIVE ISSUANCE RATE Let \(\F{f}{c}\) be the staked funds ratio at the end of cycle \(\IL{c}\), the adaptive issuance rate for cycle \(\IL{c+3}\) is defined as:

Adaptive rewards¶

Before adaptive issuance activation, participation rewards are fixed values defined by protocol constants. With the proposed mechanism, the adaptive issuance rate provides instead a budget for the whole cycle, which gets allocated equally to each block of the cycle and distributed between the various rewards, in proportion to their relative weights.

ADAPTIVE ISSUANCE PER BLOCK Let \(\supply{c}\) be the total supply at the end of cycle \(\IL{c}\), the maximal issuance per block for cycle \(\IL{c+3}\) is defined as:

Where 3153600 = \(\IL{\frac{365 \tmult 24 \tmult 60 \tmult 60}{10}}\) is the maximal number of blocks produced in a year, given a minimal block time of 10 seconds.

REWARD WEIGHTS The Adaptive-Issuance/Staking proposal defines the weights for participation rewards as:

Attestation (formerly, endorsing) rewards : 10,240.

Fixed baking reward: 5,120.

Bonus baking reward: 5,120.

Nonce revelation tip: 1.

VDF tip: 1.

The total sum of all weights is \(\tw\) = 20482. The total issuance per block, \(\IL{\isb{c}}\), is distributed amongst the different rewards in proportion to their weight.

Consensus rewards. Since the adoption of Tenderbake, Mavryk protocols before the Adaptive-Issuance/Staking proposal have rewarded delegates for their participation in consensus with the following rewards per block:

A fixed baking reward, given to the delegate which produced the payload of the block (i.e. choosing transactions, and other non-consensus operations).

A variable, baking bonus reward given to the delegate which produced the block included in the chain. This bonus is given for including attestations, if their combined attesting power exceeds the minimal threshold (two thirds of total slots).

A collective attestation reward, for attesting block proposals, distributed at the end of the cycle to the delegates selected in the consensus committees for that cycle, proportionnaly to their expected participation.

We refer to the consensus page for further insight on the pre-requisites and distribution of these rewards. Here, we derive the new formulas which compute their values per block for a cycle \(\IL{c}\):

Note that these formulas change the value of available rewards, but not why and how they are awarded. Hence, \(\IL{\rw{bonus}{c}}\) still denotes the maximal value for this reward: the actual reward issued depends on the total number of attested slots in a block. Similarly, \(\IL{\rw{attestation}{c}}\) is also a maximal value per block, as the basis for computing the share of selected delegate at the end of the cycle, the actual allocation of the rewards being subject to the existing participation conditions.

Nonce and VDF revelation tips. The rewards allocated to delegates for contributing to random seed generation (that is, for revealing nonce seeds and posting VDF proofs) are not paid each block, but rather every 192 blocks. The adjusted formulas result:

The Adaptive-Issuance/Staking proposal implements a new RPC

endpoint,

/issuance/expected_issuance, which reports the precomputed values of

all participation rewards, for the cycle

corresponding to the queried block level, and the next 3 cycles.

New Staking mechanism¶

Staking is an evolution of the existing Mavryk Liquid Proof-of-Stake mechanism. It introduces a new role for network participants, called staker, complementary to the existing delegate (also known as baker) and delegator roles. A staker must also be a delegator – that is, they must first choose a delegate.

When stakers stake funds towards a delegate’s staking balance, the associated baking and voting powers accrue to that delegate. Similarly to how delegated funds work, staked funds remain within the staker’s account at all times.

Staked and delegated funds have different weights in the computation of delegates’ baking and voting powers: staked funds (both external stakes by stakers and the delegate’s own) count twice as much as delegated funds.

Unlike delegated funds, staked funds are considered to contribute to the security deposit associated with their chosen delegate. Thus, they are subject to slashing if the delegate misbehaves by double-signing block proposals or consensus operations, and are subject to the same withdrawal delays – colloquially, they are “frozen”.

Stakers are slashed proportionally to their contribution to the delegate’s staking balance. To simplify slashing, double-baking penalties are now proportional to staked funds: instead of the previous fixed sum of 640 mav they are now set to 5% of the delegate’s stake. Moreover, denunciation rewards (both for double-baking and double-attestations) are reduced from one half to one seventh of the slashed funds. The chosen value prevents adversarial delegates from abusing the slashing mechanism for profit at the expense of their stakers.

Delegates configure their staking policy by setting staking parameters which regulate whether they accept stakers (the default being to reject them), and if so, up to which fraction of their total staking balance. They can also configure which proportion of the staking rewards from other stakers is set to accrue to their own staked balance instead. As participation rewards are automatically shared between delegates and their stakers, delegates can use this parameter to collect an edge from the rewards attributable to their stakers.

If and when the Adaptive-Issuance/Staking proposal activates, freezing and unfreezing of staked funds will be controlled directly by delegates and stakers, and will no longer be automatic. This entails that staked funds are frozen until manually unfrozen by stakers. This is a two step process which spans for at least 4 cycles (cf. Staked funds management).

A new user interface is provided for delegates and stakers to interact

with the mechanism. It is based on four pseudo-operations: stake,

unstake, finalize_unstake, and set_delegate_parameters.

Pseudo-operations are self-transfers: a transfer operation where the

destination matches the source – each involving a special entry-point of

the same name introduced for implicit accounts.

This approach was chosen to minimize the work required by wallets,

custodians, exchanges, and other parties to support the functionality.

NB Until feature activation: only delegates can stake funds and the relative weight of staked and delegated funds remains unchanged. In the current implementation, only implicit accounts can become stakers. In other words, smart contracts cannot stake funds (they can of course still delegate them).

Staking policy configuration¶

Delegates can configure their staking policy by setting the following parameters:

edge_of_baking_over_staking: a ratio between 0 and 1, whose default value is 1. This parameter determines the fraction of the rewards that accrue to the delegate’s frozen deposit – the remainder is shared among its stakers.limit_of_staking_over_baking: a non-negative number, denoting the maximum portion of external stake by stakers over the delegate’s own staked funds. It defaults to 0 – which entails that delegates do not accept external stakes by default. It is moreover capped by a global constant, set to 5 in the Adaptive-Issuance/Staking proposal, which ensures the baker controls a significant part of the stake.

Delegates can modify these staking parameters at all times, using the

set_delegate_parameters pseudo-operation: that is, by transferring 0

mav to their own set_delegate_parameters entry-point. The chosen values for both

parameters need to be supplied. The new parameters are then applied

DELEGATE_PARAMETERS_ACTIVATION_DELAY (currently 5) cycles later.

mavkit-client transfer 0 from <delegate> to <delegate> --entrypoint set_delegate_parameters --arg "Pair <limit as int value in millionth)> (Pair <edge as int value in billionth> Unit)"

or more conveniently:

mavkit-client set delegate parameters for <delegate> --limit-of-staking-over-baking <value> --edge-of-baking-over-staking <value>

On overstaking and overdelegation. Note that if a delegate’s

limit_of_staking_over_baking is exceeded (that is, the delegate is

overstaked), the exceeding stake is automatically considered as

delegation for the delegate’s baking and voting power calculation, but

it does remain slashable. The new mechanism does not alter

overdelegation (delegated funds beyond 9 times the delegate’s own

stake) nor its consequence on voting and baking powers. That is,

overdelegated funds are not counted towards a delegate baking power, but

they do increase their voting power.

Staked funds management¶

Stakers (and delegates) can use the stake, unstake, and

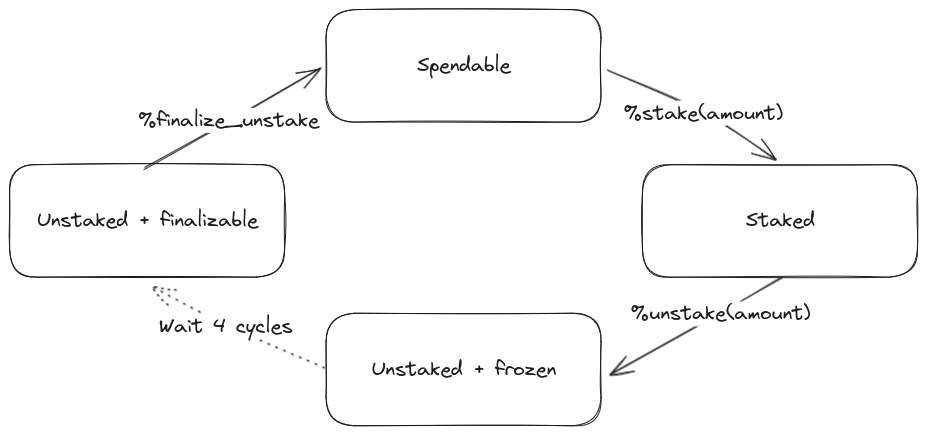

finalize_unstake pseudo-operations to control their stakes. Figure

2 illustrates their effect on a staker’s funds. Note that

while these pseudo-operations change the state of the involved funds,

they remain otherwise within the staker’s account at all times.

Figure 2: staked funds management using pseudo-operations.¶

To stake funds, a delegator uses the stake pseudo-operation,

transferring the chosen amount of spendable mav to their own

stake entry-point. The staked mav will then be frozen and

contribute to their chosen delegate’s staking balance. Note that the

stake pseudo-operation will fail if the sender account is not

delegated.

mavkit-client transfer <amount> from <staker> to <staker> --entrypoint stake

or more conveniently:

mavkit-client stake <amount> for <staker>

To unstake funds, a staker first submits an unstake request with the

unstake pseudo-operation. This is implemented by transferring the

chosen amount in mav to their unstake entry-point:

mavkit-client transfer <amount> from <staker> to <staker> --entrypoint unstake

or more conveniently:

mavkit-client unstake <amount|"everything"> for <staker>

The requested amount will be unstaked but will remain frozen. After 4 cycles, unstaked frozen tokens are no longer considered at stake nor slashable. They are said then to be both unstaked and finalizable.

A staker can retrieve all unstaked and finalizable tokens at any time,

making them spendable again. This is done using the finalize_unstake

entrypoint -– that is, by transferring 0 mav to their

finalize_unstake entry-point:

mavkit-client transfer 0 from <staker> to <staker> --entrypoint finalize_unstake

or more conveniently:

mavkit-client finalize unstake for <staker>

In some circumstances, unstake and finalize can be done implicitly: any call

to stake or unstake will implicitly finalize all currently finalizable pending

unstake requests. Also, as we will see next, change of delegate triggers an

unstake operation.

Change of delegate¶

When a staker changes its delegate, the operation will trigger an implicit unstake request for the full frozen deposit of the staker.

As long as the unstake request is not finalized, the frozen tokens will continue to be delegated to the old delegate, however the spending balance of the account is accounted in the new delegate’s stake. It will not be possible to stake with the new delegate as long as there are unfinalizable unstake request for token staked with the old delegate.

Feature activation vs protocol activation¶

Should the Adaptive-Issuance/Staking proposal be accepted by the community, and once the protocol becomes active on Mavryk Mainnet, most of the features described in this document will not be enabled by default, only latent possibilities in the protocol, waiting for a separate activation.

In particular, the following changes will require additional approval from delegates via separate feature activation vote mechanism:

Adaptive issuance – including notably the changes to the computation of consensus rewards.

Ability for delegators to become stakers – until feature activation delegates continue to be the only participants who can stake funds.

The changes in weight for staked and delegated funds towards the computation of baking and voting rights.

Other changes described earlier would be enabled from the Adaptive-Issuance/Staking proposal’s activation:

The new interface for stake manipulation based on pseudo-operations. Note that this entails the deprecation of the

set/unset deposits limitinterface and also the end of automatic deposit freezing.The changes in slashing penalties (double-baking penalties are set to 5% of the staked funds) and denunciation rewards (they amount to one seventh of slashed funds).

Changes to protocol constants. Note that this entails calculating participation rewards using the weight-based formulas, but these are defined so that they match the previous values when Adaptive Issuance is not active.

Activation Vote¶

We highlight the following principles behind the feature activation vote mechanism:

If and when the Adaptive-Issuance/Staking proposal activates, delegates can start voting for (On) or against (Off) the feature activation of the changes listed above in each block they bake. They can also abstain with a Pass vote.

These votes are cast by block-producing delegates, and are included in block headers.

Participation is not mandatory, defaulting to Pass in the absence of signaling.

The feature activation vote has two phases: a Voting phase and a subsequent Adoption phase.

The Voting phase is driven by an Exponential moving average (EMA) whose half-life is 2 weeks. That is, it takes two weeks for the EMA to raise from 0% to 50% assuming only On votes are cast.

The target threshold is a supermajority of 80% of On votes over On plus Off votes.

There is no time limit or fixed duration for the Voting phase. It continues as long as the threshold is not met. There is no quorum either, the lack of participation (reified as Pass votes) is not taken into account by the EMA, and hence only affects the time required to reach the threshold.

If the threshold is met, the Voting phase will complete at the end of the current cycle, and the Adoption phase will start at the beginning of the following cycle.

The Adoption phase lasts 5 cycles. The beginning of the cycle following the end of the Adoption phase activates the guarded features.

There is no automatic deactivation of the guarded features once in (and after) the Adoption phase – subsequent votes continue to be counted towards an updated EMA, but without any further effect.

NB In the implementation in the Adaptive-Issuance/Staking proposal, the issuance rate is computed 3 cycles in advance. Thus, in the first 3 cycles where is active, the protocol does not use the adaptive reward formula and keeps using the current reward values.

- 1

Note that if the nominal annual issuance rate is \(r\), the annualized rate is close to \(\IL{\exp{r} - 1}\) as it is compounded at every cycle.